As 2022 nears a wrap, a trend is emerging that’s expected to gain traction next year — actively managed investment strategies — along with a custom strategy for people who like the idea of investing in a basket of companies, but want more control of what they invest in.

Assets in direct indexing are expected to climb to $825 billion by 2026, from roughly $462 billion now, according to Cerulli Associates, a global research and consulting firm, based in Boston, Mass. That tops growth forecasts for exchange-traded funds, mutual funds and separately managed accounts.

Here’s what’s behind the developing shift: Many analysts foresee loads of volatility for stocks in 2023, particularly early in the year, and an overall flat return scenario for the entire year, given the combo of still-high inflation, Fed rate hikes, and a potential recession. And some folks want more control.

“It’s part of a much broader trend towards personalized portfolios,” told Tom O’Shea, director at Cerulli.

Direct-indexing enters the mainstream

Direct indexing lets investors cherry-pick which stocks to buy in a benchmark index instead of owning a fund that tracks a specific gauge like the S&P 500.

A hands-on approach allows for you to adjust for changing market conditions in a turn-on-the-dime manner, something that is not in the cards for investors in passively managed retirement portfolios that mimic the ups and downs of whichever index is being tracked.

“Direct indexing allows investors to buy the individual stocks in an index directly as opposed to owning a predetermined selection of stocks through a fund,” told Marguerita Cheng, a Certified Financial Planner and CEO at Blue Ocean Global Wealth, in Gaithersburg, Md. “Investors can customize their holdings to align with their risk tolerance and investment preferences.”

“But there are some cons,” Cheng added. “Direct indexing, for example, can be more expensive than passive investing and may cause clients to lose focus of their long-term financial goals and encourage more frequent trading.”

Plain vanilla index funds vs DIY

Investing in Steady Eddie index funds — balanced across stocks, such as the S&P 500 index, and fixed-income bond funds put on auto-pilot for months on end — has been standard advice for many individuals, particularly those socking away retirement funds.

The overarching idea is that it’s simpler and less expensive to buy an entire index that is computer-generated than it is to try to select individual stocks to buy and sell. And, generally speaking, you have a better chance of shaking off the slumps in the stock market if you simply stay the course. Moreover, trying to find the perfect time to invest is tricky and almost always a huge mistake.

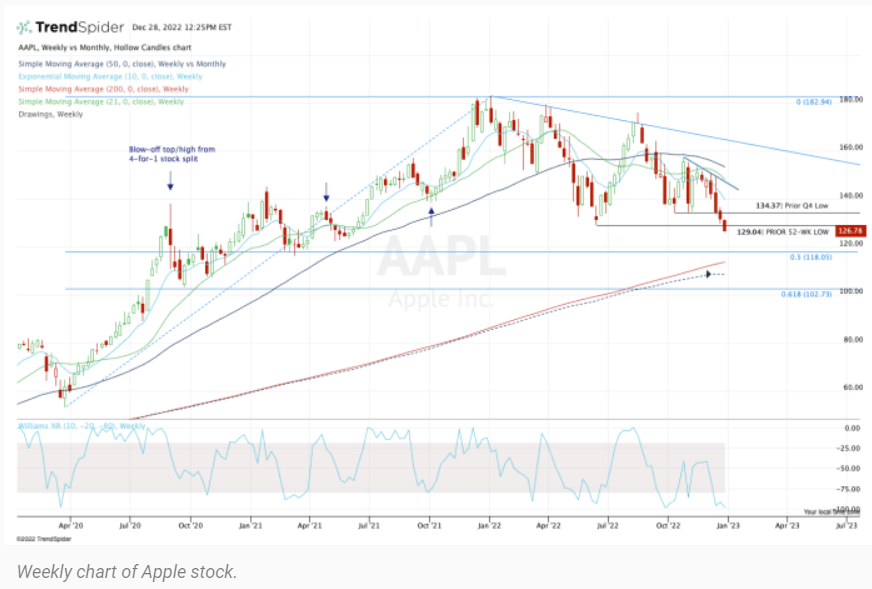

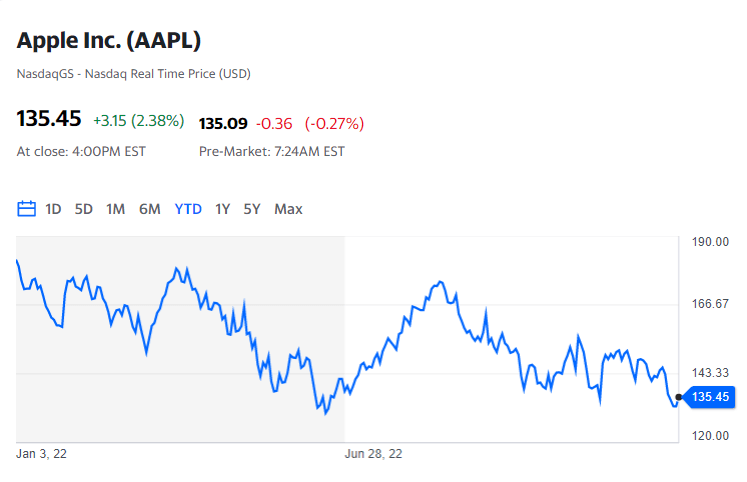

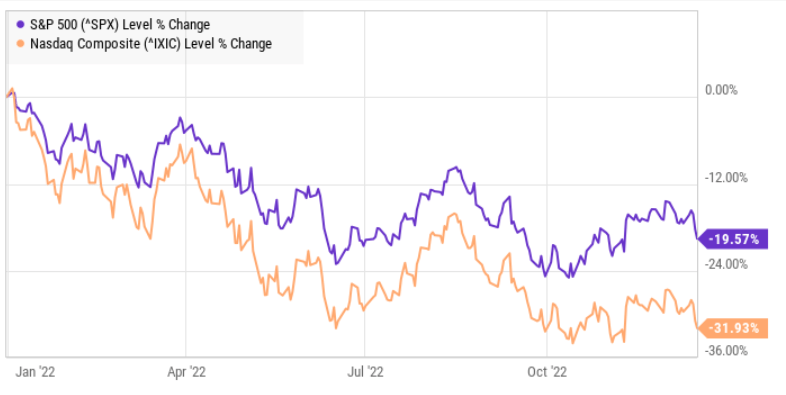

For scores of retirement savers, however, that passive strategy has been hard to stomach this year as markets have been pummelled. With inflation not yet under control and the overall stock market still teetering–the S&P 500 index has fallen around 19% so far this year, it’s hard to fight back the urge to step in and tweak your accounts, especially if you’re nearing retirement.

“Firms that cater to do-it-yourself investors like Schwab, Vanguard, and Fidelity are rolling out these personalized products and what we’re seeing is there’s a lot of investors who like to own individual securities for a variety of reasons,” O’Shea said.

“The tax benefits are one reason these have appeal,” he said. “They’re not necessarily buying into a mutual fund that has embedded capital gains, for example. They’ll be able to customize their portfolio according to their taxes. And then other characteristics that they might find important. It could be risk, maybe a low volatility portfolio. It could also be ESG, which is increasingly becoming important, particularly to young people.”

A custom solution

This year, Fidelity, for example, launched customized index funds for do-it-yourself brokerage customers. To create a custom index, you pick a group of stocks that you want to invest in based on whatever theme you choose — say, clean energy stocks — then determine the percentage weighting of each investment and invest all those stocks in a single basket.

After a free trial, the service costs $4.99 per month. The custom baskets can be used in non-retirement brokerage accounts, including Health Savings Accounts (HSAs) as well as Traditional IRAs, Roth IRAs, and rollover IRAs. You can invest in up to 50 stocks and create as many baskets as you want.

“We knew investors wanted more than just basket trading; they want a simplified way to monitor and trade their customized portfolios with just one click, and trade securities using Fidelity’s real-time fractional shares engine,” Josh Krugman, senior vice president of brokerage at Fidelity, told Yahoo Money. “This new ability to invest in and customize portfolios built from Fidelity’s thematic models puts direct indexing capabilities into the hands of DIY retail investors.”

Yet, recent Cerulli surveys show that only 14% of financial advisors are aware of, and recommend, direct indexing solutions to clients. For now, these hands-on offerings are still a small slice of the overall mutual fund sandbox.

“For tax-deferred or tax-free retirement accounts, more control over taxes may not be as compelling as rebalancing can occur without incurring tax consequences,” Cheng said. “For taxable accounts, flexibility and control with regards to taxes and security selection can be beneficial depending on the client’s personal and financial circumstances.”

The case for a blended strategy

Passive investing, however, isn’t fading away, by any measure.

In 2021, passively managed index funds for the first time accounted for a greater share of the U.S. stock market than actively managed funds’ ownership, according to the Investment Company Institute’s 2022 Factbook. Passive funds accounted for 16% of the U.S. stock market at the end of 2021, compared with 14% held by active funds. A decade ago, active funds held 20% and passive ones, 8%.

“I don’t buy this idea of the end of passive investing for a minute,” told Daniel Wiener, chairman of Adviser Investments, in Newton, Mass. “I have not heard or read of a single person of any substance saying that the end of passive investing is nigh.”

Importantly, fees are low for pre-set index baskets of stocks and bonds.

In 2021, the average expense ratio of actively managed equity mutual funds was 0.68%, compared with average index equity mutual fund expense ratio of 0.06%, according to a report by the Investment Company Institute. Active management ETFs have an average expense ratio of 0.69%.

The passive approach of set and forget makes perfect sense, particularly if you’re investing for the long haul and aren’t hardwired to be a stock jockey. The batting averages also support passive investing.

Over the past 15 years, more than 70% of actively managed funds failed to outperform their comparison index in 38 of 39 categories, according to the S&P Dow Jones Indices (SPIVA) mid-year 2022 survey on the performance of active mutual fund managers.

Moreover, the S&P 500 has increased on average by 29% in the three years following a 20% plus decline dating back to 1950, according to data analysis by Truist chief market strategist Keith Lerner.

“It doesn’t hold water – if expectations are that returns will be lower in the years ahead then both passive and active funds with low expense ratios should be the preferred investment vehicles,” Wiener said. “So, T. Rowe Price, Vanguard, and Fidelity funds with low operating expenses, as well as low expense ratio ETFs, will remain the preferred investments.”

Source: finance.yahoo.com