Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

It has exceptional passenger roominess and looks dirt-road ready.

The 2024 Honda Prologue is an all-electric, 2-row midsize SUV and the automaker’s first electric SUV of any sort. It will compete with the growing group of electric SUVs priced between $40,000 and $50,000, and likely offer a max range of beyond 300 miles when it goes on sale in 2024.

How much will the Honda Prologue cost?

We expect the Honda HMC, 2.42% Prologue electric vehicle to start in the mid-$40,000 range. For reference, the Ford F, -1.28% Mustang Mach-E currently starts at $46,895, and the Hyundai HYMTF, +2.40% Ioniq 5 kicks off at $39,950.

When does the Honda Prologue go on sale?

The Honda Prologue debuted in October 2022, and Honda says it will go on sale in 2024. Because it’s also a 2024 model, we expect it will start hitting dealerships early that year.

How big is the Honda Prologue?

The 2-row, 5-passenger Prologue is notably longer and a bit taller than presumed competitors like the Hyundai Ioniq 5 and Ford Mustang Mach-E. It’s also longer than Honda’s own Passport midsize SUV, but not as tall. A long wheelbase of almost 122 inches promises exceptional passenger roominess.

Wheelbase: 121.8 inches

Length: 192.0 inches

Width: 78.3 inches

Height: 64.7 inches

Wheel diameter: 21 inches

Attractive exterior

Honda played it pretty safe with the Prologue’s exterior design, but we definitely like the look. It’s clean, substantial, and has a few premium-like elements, angles, and features. It also looks ready and willing to venture down some dirt roads, not just capable of doing so.

In back, the Honda badge has been replaced with “Honda” spelled out. But instead of using all capital letters, as it’s typically done, Honda’s execution features a capital H followed by lower-case letters. So Honda.

Sleek interior

The Prologue’s passenger cabin combines familiar Honda interior design sensibilities with two large screens and what looks to be an accommodating center console. It looks more like a contemporary Honda than a futuristic EV, which we suspect many buyers will appreciate.

Range and charge times

While Honda has yet to release any Prologue range, charging, or battery details, we can look to the forthcoming Chevy Blazer EV for clues. Why the Blazer EV? Because the Prologue is the product of a partnership with GM GM, -0.65% and is built on its new electric vehicle platform. We expect the Prologue to be sized and priced similarly to the Blazer EV, which offers about 250 miles of range on the low end, and up to 320 miles at the top end of the lineup.

As for charging, the Prologue’s platform-mate has an 11.5 kW onboard AC charger for plugging in at home, and DC public fast-charging capability of up to 190 kW. Depending on the model and the charger, the lithium-ion battery can absorb 87 miles worth of electricity in just 10 minutes. We wouldn’t be surprised to see the Prologue post similar figures all around.

Source: finance.yahoo.com

The concept of smartphones and electric cars seemed like a pipe dream 20 years ago, but today, nearly 6.92 billion people, or 86.4% of the global population, have personal smartphones. Governments worldwide are moving toward a green future by encouraging the use of electric cars instead of vehicles with combustible engines.

Investing in burgeoning technologies could increase your wealth within the next two decades. Take look at some of the most promising technologies poised to catch on.

In recent months, generative artificial intelligence (AI) has taken a much larger role in daily life than normal. ChatGPT is rewriting curriculums and being used at publications like Buzzfeed Inc. But that’s just the beginning. While ChatGPT has been growing in prominence, other aspects of the field have been under-reported.

For example, RAD AI is a startup using generative AI to increase the efficiency of marketing campaigns with the world’s first AI marketing platform built to understand emotion. The startup is raising on startup investing platform Wefunder and has raised over $2.5 million from everyday investors.

Other types of generative AI examples include programs used to generate images, paintings, drawings, text-to-speech and full videos using nothing but AI.

2021 was a pivotal year for commercial space exploration, with startups such as Jeff Bezos-backed Blue Origin LLC and Elon Musk’s Space Exploration Technologies Corp. (SpaceX) successfully kickstarting commercial space travel. Virgin Galactic, backed by billionaire Richard Branson, also launched the first fully crewed flight to the edge of space in July 2021.

These startups are gearing up to begin commercial space travel by 2024. But given recession concerns and supply chain issues, no concrete plans have been made. Many companies delayed their schedules by at least a year as the macroeconomic headwinds piled on.

With tickets priced at nearly $500,000 each, commercial space travel is currently only accessible to high-net-worth individuals. But you can expect prices to drop over the next two decades, as companies invest heavily to develop sustainable space stations and other infrastructure. China Business Knowledge predicts space travel to become more affordable over the next 15 to 20 years, stating, “Many people alive today will have a real chance of traveling to space in their lifetimes.”

The majority of policies developed by nations over the past two years has been focused on transitioning to carbon-neutral energy. While the energy crisis resulting from the prolonged Russia-Ukraine war has thrown off the timeline, several countries have pledged to phase out fossil fuel emissions to eliminate their carbon footprints by 2050.

Solar, wind and geothermal energy are at the forefront of this transition, and the popularity of hydrogen as an alternative source is peaking. Green hydrogen has immense applications across the agriculture, manufacturing and transportation industries. Boston-based startup Electric Hydrogen, which produces green hydrogen from water, raised $198 million in Series B funding last June.

While green hydrogen production is expensive, scientists worldwide are working toward developing ways to produce carbon-neutral hydrogen commercially. Norwegian fuel cell company Nel ASA, the world’s largest manufacturer of electrolyzers, expects green hydrogen production costs to become equivalent or lower than fossil fuel production by 2025 at the earliest.

The private equity market is dominated by venture capitalists and angel investors. This has been a point of contention for retail investors for some time. It triggered the meme stock rally in the last two years as retail traders used social media to create immense selling pressure on institutional investors.

But with the rising popularity of startup investments among everyday investors, companies are working on establishing a solid secondary market for reselling private equity assets. Startups typically remain private for 10 to 12 years before becoming mature enough to go public while seed money invested remains locked in. But with the development of a secondary trading market, institutional and retail investors do not have to wait for an initial public offering (IPO) to cash in their investments.

StartEngine, the largest equity crowdfunding startup in the U.S., is working toward developing an inclusive secondary market for trading such securities. As the private equity market rapidly evolves, secondary trading markets facilitating reselling of such asset classes are expected to be one of the biggest advances in the retail investing space.

Source: finance.yahoo.com

After serving as YouTube’s Chief Product Officer for over seven years, Neal Mohan was appointed last week to lead the Google-owned streaming platform after former CEO Susan Wojcicki said she’d be stepping down.

His ascendance bodes well for fans and advocates of Web3 technologies.

Wojcicki announced her resignation in a blog post. In praising Youtube’s “incredible leadership team,” she commended Mohan for playing a pivotal role in the launch of products like YouTube TV and YouTube Music, stating he’ll be a “terrific leader.”

Wojcicki also praised Mohan for his robust understanding of YouTube as both a business and one of the most popular places for communities to congregate. “He has a wonderful sense for our product, our business, our creator and user communities, and our employees,” Wojcicki wrote.

As one of the most popular websites in the world, the popularity and reach of YouTube cannot be understated. From September to November last year, the website ranked only behind Google in terms of use, with 74.8 billion visits on average per month, according to Statista.

During his long tenure shaping YouTube’s offerings, Mohan has kept an open mind about the evolution of the internet and its assorted platforms. Last year, he disclosed in a blog post that YouTube was looking at ways it could possibly integrate Web3 technology, whether by “making YouTube more immersive” by leveraging the metaverse or tapping technology like NFTs, unique digital tokens that are often used to assert ownership of online content.

“We believe new technologies like blockchain and NFTs can allow creators to build deeper relationships with their fans,” Mohan wrote. “There’s a lot to consider in making sure we approach these new technologies responsibly, but we think there’s incredible potential as well.”

For example, Mohan wrote that NFTs could be a compelling, “verifiable way for fans to own unique videos, photos, art, and even experiences from their favorite creators,” adding it would allow creators and audiences to collaborate in new ways.

In terms of the metaverse, Mohan stated the technology’s use is “still in its early days” but said YouTube will “work to bring more interactions to games and make them feel more alive.”

YouTube CEO Hints at NFT Integration in Letter to Creators

Even though the concept of a metaverse isn’t explicitly built around blockchain technology—the term was coined in 1992 by author Neal Stephenson in his science fiction novel “Snow Crash”—popular projects like The Sandbox and Decentraland use blockchain technology to establish the ownership of digital land and other assets.

Google itself has also leaned more heavily into Web3 services within the past year. In October, the company announced the launch of a cloud-based service for Ethereum projects and developers called the Blockchain Node Engine.

The service both hosts and automatically manages individual nodes that contribute to a blockchain’s network, bringing the “reliability, performance, and security [people] expect from Google Cloud compute” to the digital assets industry.

The tech giant revealed the following month that it would expand its Blockchain Node Engine to the Solana Blockchain as well, a feature set to launch in the first quarter of this year.

YouTube Is Eyeing the ‘Incredible Potential’ of NFTs and Web3 for Future Products

Google also gave a nod to Ethereum last September as the network transitioned to a less energy-intensive form of verifying transitions, a long-awaited process referred to as the merge. A “doodle” featured in Goolge’s search engine counted down how long it would take for the process to be complete and other stats related to Ethereum’s change in power consumption.

YouTube has seen some prominent employees fully embrace Web3, such as its former Global Head of Gaming Ryan Wyatt, who left after seven years at YouTube to join Polygon Studios as CEO in February 2022 and has since shifted to serve as President at the rebranded Polygon Labs.

Watt recently told Decrypt that he sees parallels between YouTube and Polygon, a sidechain that runs in tandem with Ethereum and seeks to improve on its counterpart by offering faster transactions and lower fees while serving as a platform for interoperable blockchains.

“There’s a lot of similarities between YouTube and Polygon in the sense [that] it’s a platform, and you’re helping people onboard onto it,” he said. “It’s creators in all types, uploading gaming videos, all the way to now, [where it’s] games and projects being built.”

Source: finance.yahoo.com

More and more Netflix (NFLX) users are expressing their concerns (and confusion) over the streamer’s crackdown on password sharing.

Earlier this month, Netflix revealed the first details of the crackdown after an update appeared on the company’s help center which appeared to show the streamer would require users to identify a “primary location” for all accounts that live within the same household.

Netflix later clarified that information was only applicable to the test countries at the time, which included Chile, Costa Rica, and Peru. Last week, however, the crackdown expanded into Canada, New Zealand, Portugal, and Spain, which set off a new wave of customer concerns.

Over the past few weeks, Netflix users have flooded our inbox with thoughts, concerns, and questions surrounding the crackdown.

Many have threatened to cancel if extra fees are implemented, with some implying the move will likely help boost competitors like Amazon Prime Video (AMZN) and Disney+ (DIS).

Yahoo Finance has reached out to Netflix for clarity surrounding the most-asked about questions and was directed to the platform’s help center pages which details the rules for each specific country where the crackdown has been rolled out. (Remember: there has been no U.S. announcement so far)

According to the help center, “a Netflix account is meant to be shared in one household (people who live in the same location with the account owner).”

“People who are not in your household will need to sign up for their own account to watch; or in some countries you can buy an extra member and add them to your account,” Netflix said.

The company added account holders can manage and update their primary location through the Netflix app. Users can also easily access their accounts while traveling or on vacation.

Still, some users remain uneasy about the changes. Below are the top thoughts and concerns from our readers:

Liz C.

I’m a Canadian that pays for a premium Netflix account, so we can have up to 4 devices logged in at a time. We watch it on our cable box, and our two children watch it on their laptops at University. So now Netflix wants us to pay an additional $7.99 for additional users? My frustration is they are not making any money because costs of their movies and series is increasing, or costing too much. …Then stop spending so much on them? This sounds like a “you problem” not a me problem. I am paying enough for tuition, groceries and rent for my kids, now you want me to pay more? Stop being so greedy.

Hunt D.

One aspect of this story that I am not seeing mentioned in Canadian media is the impact of snowbirds. Over a million Canadians travel south for much of the winter, and the Netflix changes seem to eliminate our ability to use Netflix if we are away from our Canadian homes for over a month. …We have not cancelled yet, but according to Netflix we will be locked out of our account on the 21st, so they may see a wave of cancellations at that time from Canadians who do not have access to their home wifi this time of year.

Jeff K.

I understand Netflix’s desire to stop five friends that don’t live together sharing one account login, but that is how they built their business. Families with children away at university would be considered part of the household under the Stats Can definition, since their primary residence is still with their parents. It is not a simple issue, but I feel Netflix has gone too far, unnecessarily.

I have been a Netflix customer for years and seen numerous price increases. It started at about $8/month and is now $23/month. If I need to add another location, then I will most likely put Netflix on a rotation schedule throughout the year along with the other streaming services that I do that for; Disney+, Paramount+, Apple.

Amanda G.

If the policy change makes it that we would have to pay full price for a subscription, we would not add the service. The reality is each subscription service provides limited options at this point, and frankly I believe people will be returning to illegal downloads. Netflix was a draw because it meant we could get rid of our overpriced cable service. At this point, by needing multiple streaming services it will end up as being as expensive as cable.

While I understand these are all businesses that want to make a profit, I believe it will end up being a short sighted approach.

The economy is rapidly entering a recession. Streaming services are not a need and are an easy service to cut to save money. Netflix likely will only be the first to move towards preventing account sharing, but unlike Amazon prime, which offers an additional service for the cost, or Disney plus, which has the most popular children’s programming, they have little to make themselves imperative for the viewer.

Annette C.

This password crackdown is discriminatory to families whose children live in two households. Life is disruptive and chaotic as it is for two-household children and their ability to access their own content on streaming platforms across two-households helps establish some stability and reliability in their lives.

Eric W.

I stay at three other locations beside my home each month.

This Netflix agreement is reducing my livelihood and subjecting me to hardship.

Netflix has made new agreements with actors and film production companies and piggy backing on consumers to pay for their deals through these agreements!

Peter K.

One of our two sons attends university locally and lives at home (no Netflix problem there) The other one studies in another province. But although he’s at home occasionally, most of his Netflix use is away from home (Netflix will likely force him to get his own account- as if students these days have more money to spend…)

My wife and I are retired and travel a lot. Months at a time. But we live on a budget. …We enjoy our Netflix account, but overall, the whole family is a rather occasional user.

Phil K.

My brother and I share a Netflix account. He lives elsewhere in the city.

I pay for the entire HD package. I have decided if they implement this I will cancel. We currently have Prime, Crave & Apple at times. So don’t need Netflix. Paying $23.30 a month is not worth not being able to share. We both live alone. Those are my thoughts.

Donna M.

As a snowbird on a fixed income, I have chosen Netflix as my streaming service. The new Netflix changes do not accommodate individuals/couples that spend part of the year out of their primary residence and they are asking snowbirds to pay the additional $7.99 monthly user fee to be able to stream when away from their primary residence, despite the primary residence not using Netflix during that time. …I was told by Netflix customer service that I couldn’t share between my two residences unless I added the second one to my plan.

I get them trying to reduce password sharing outside the home, but am really disappointed in them restricting the use of the primary account holder who travels.

I will be canceling the service and really hope these changes prove to be disappointing to them.

Julie W.

One extremely important aspect of password sharing I have yet to see addressed, are those serving in the military, especially those who have spouses on deployment and can access Netflix.

Patrick C.

I feel like my issue with Netflix is a first world problem since we have 2 homes but I believe there are enough of us that Netflix will need to have a solution. I doubt we would cancel if they come up with a reasonable fix.

Cara L.

I’m wondering if this crackdown includes the account access that’s included with some contract phone companies now because Verizon and T-Mobile include Netflix and Paramount+ with their plans. I share a phone plan my friends and don’t live in the same household because if so then that’s not fair since it was included in our phone plan when my friend signed us up through T-Mobile.

Michael J.

While I respect and appreciate where Netflix is coming from I also have a serious question.

My parents and I do not share an account they have their own they pay for it and we pay for ours but they snowbird between a Northern State and a Southern state half the year. They own property in both places they use one Netflix account though. They don’t bother to change their primary address they forward their mail for 6 months out of the year. Changing their primary residence location would be very difficult and require them to change their credit card information and the bank information just so that they could tie it to something like Netflix and set an address half the year to something else.

They’re really worried about this change in Netflix I don’t know how to contact Netflix and tell them my concerns about this but I liked your article and I just wanted to tell our story. I was thinking about how I’m going to help my parents they’re obviously not going to be able to go home and get on their Wi-Fi to get recertified and I’m not going to tell them they should change their address and billing information just to cope with the new rules so what should they do? They’re legitimate paying customers who migrate and if migrating is going to be difficult they’ll probably just cancel the account and I wouldn’t blame them.

I believe Netflix has a right to curtail their service to prevent theft of their service of a sort. But they’ve got to find a balance between doing what’s right for them and what’s fair for their customers. We don’t all live the same life or in the same way. If people pay for the service they should be able to use it no matter where they are.

Source: finance.yahoo.com

Employers who use chat bots and Artificial Intelligence (AI) tools to screen job seekers should prepare for new laws geared to prevent bias in the hiring process.

In April, a New York City law that regulates how companies use AI in hiring is expected to kick in. The Biden Administration and the U.S. Equal Employment Opportunity Commission (EEOC) also recently published initiatives to make employers responsible for monitoring the tools—and any discriminatory practices they might trigger before a candidate even connects with a hiring manager.

“Nearly 1 in 4 organizations use automation or AI to support HR-related activities, with roughly 8 in 10 of those organizations using AI in recruitment and hiring,” Emily M. Dickens, chief of staff and head of public affairs at SHRM, The Society for Human Resource Management, told.

“Regulation is coming and it’s going to be messy,” said Avi Gesser, partner at Debevoise & Plimpton and co-chair of the firm’s Cybersecurity, Privacy and Artificial Intelligence Practice Group.

Starting in April, employers in New York City will have to tell job candidates and employees when they use AI tools in hiring, perform an independent bias audit—and notify them about “the job qualifications and characteristics that will be used by the automated employment decision tool,” according to a draft of the new Automated Employment Decision Tool law. The final set of rules has yet to be published.

“The New York law is the first time you have a broadly applicable set of restrictions on AI hiring in the way it’s normally used by lots of companies, which is to source and sort resumés in order to decide who you are going to interview for efficiency purposes,” Gesser said.

The aim of the New York law is transparency. “People who are using these tools need to disclose that they’re using the tools,” Gesser added. “They need to give people a chance to request an alternative arrangement if they don’t feel like the tools are going to be fair to them.”

And it means that employers will be the ones responsible for meeting the legal requirements around these AI tools, rather than the software vendors who create them, he said.

New York City isn’t the only one putting employers on notice. Last fall, the White House released a blueprint of its AI Bill of Rights and recounts how a “hiring tool for a firm that had a predominately male workforce rejected resumés with the word “women’s,” such as “women’s chess club captain.”

In January, The U.S. Equal Employment Opportunity Commission (EEOC) published its Strategic Enforcement Plan in the Federal Register. The focus: artificial intelligence tools used by employers to hire workers that can also introduce discriminatory decision-making. And last spring, the EEOC issued guidance on the use of AI in hiring tools that focuses on the impact on people with disabilities.

The biggest concern about AI screening tools is that they can be biased against certain applicant classes–from race and gender to age and disability to those who have gaps in their resumés. This is what regulators want to fix.

Of course, AI isn’t alone in the business of bias. Human resumé sorters have been guilty as well.

In 2021, researchers from the University of California, Berkeley and the University of Chicago sent more than 83,000 fictitious applications with randomized characteristics to geographically dispersed jobs posted by 108 of the largest U.S. employers. The findings: Distinctively Black names reduce the probability of employer contact by 2.1 percentage points relative to distinctively White names.

“It’s a mistake to judge these AI tools against some aspirational standard that humans aren’t meeting anyway,” Gesser said. “If you give the exact same resumé to two different companies and just change the name, you may find that the human reviewers treat those differently.”

Still, the AI tools are getting more sophisticated and that’s what worries regulators and prospective employees. “Today’s AI models evaluate candidates just like a recruiter, comparing the full resumé against the job description,” Morgan Llewellyn, chief data scientist at recruiting technology company Jobvite, told.

The most widely used AI tool, the automated-hiring technology known as Applicant Tracking Systems (ATS), has caused job seekers the most angst — and is what the new regs for now are aiming to eliminate. They are designed to pare down the droves of applications and resumé employers receive electronically for open positions.

In addition to screening resumés, another concerning issue highlighted in the EEOC-issued AI guidance is the increasing use of AI-led automated video interviews and the impact on people with disabilities in particular.

Candidates may be appraised by a computer algorithm on their speech cadence, facial expressions and word selection.

For example, the video interviewing software can analyze applicants’ speech patterns in order to reach conclusions through the algorithmic decision-making tool about their ability to solve problems. It is “not likely to score an applicant fairly if the applicant has a speech impediment that causes significant differences in speech patterns,” according to the EEOC publication.

More than 90% of employers use this type of screening to filter or rank potential candidates, according to a study by Harvard Business School’s Project on Managing the Future of Work and the consulting firm Accenture; the organizations surveyed 8,000 workers and more than 2,250 executives.

Another problem: ATS can dismiss applications because of resumé gaps. That’s troubling, especially for women who have stepped out of the workforce for caregiving of children or aging relatives.

“In order to use these tools going forward, you’re going to need to conduct a fairly onerous audit of how those tools’s results filter candidates by race, by gender, by ethnicity, and intersectionality by combinations of race, gender, and ethnicity,” Gesser predicted. “That’s going to be a big shift for a lot of companies who are using these tools and a pretty heavy burden.”

He added: “Every job, every candidate is different, and there’s a risk that there’ll be grounds for lawsuits and claims of discrimination.”

HR departments know the guard rails are coming. Little wonder that nearly half of employers surveyed by SHRM last year said they would like to see more information on how to identify any potential bias when using these tools.

And that may explain why the New York City law has pushed back enforcement of the law until April 15, 2023, despite the law’s January 1, 2023, effective date.

Said Dickens of SHRM: “We need to be assured the tools we use do not lead to bias in the hiring process.”

Source: finance.yahoo.com

Snap (SNAP) held its second-ever Investor Day on Thursday just weeks after another brutal quarterly report that sent shares tumbling.

CEO Evan Spiegel’s message to investors on Thursday focused on monetization, the growth of Snap’s community, the appeal of Snap’s demographic and platform to advertisers, and, of course, augmented reality (AR). And a big number — one billion users.

At the company’s Santa Monica, Calif. headquarters, Snap revealed its monthly active user base has expanded to 750 million monthly active users (MAUs), a 25% increase from 600 million MAUs 10 months ago.

The company added it sees a path to getting that MAU number to 1 billion in the next couple of years.

Meanwhile, Snap’s daily active users (DAU) currently clock in at about 375 million.

“We have everything we need to build a successful business over the long-term, a large and growing community, an innovative and engaging product that continues to evolve, a strong balance sheet with a track record of positive free cash flow and a long-term vision for what we believe will be the most meaningful advancements in computing that the world has ever seen — augmented reality,” CEO Evan Spiegel told the audience.

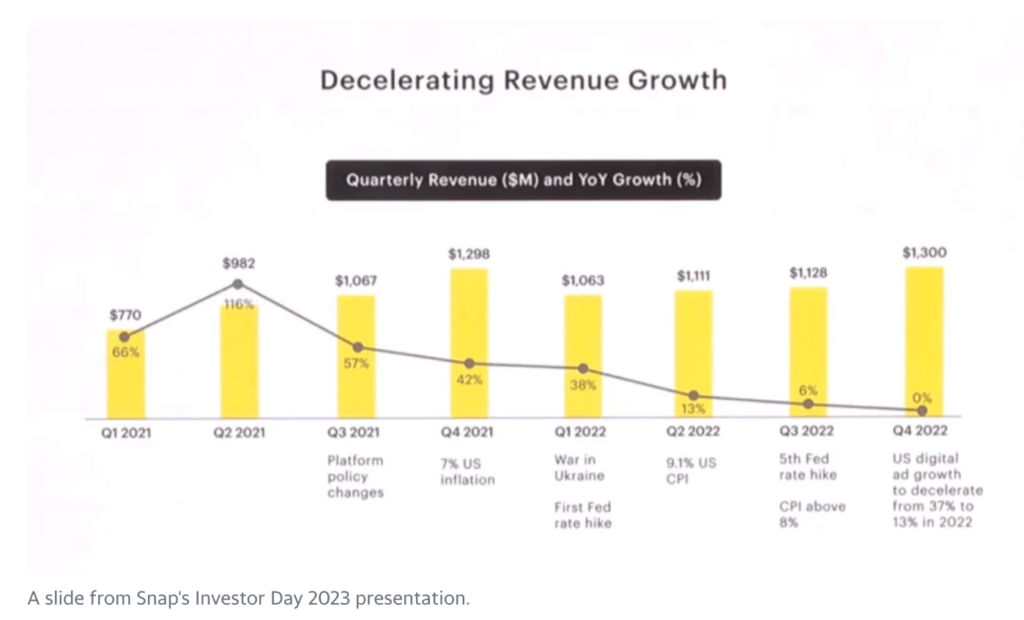

On Jan. 31, Snap reported fourth quarter results, meeting analyst estimates for revenue and user growth, but showing a net loss and weak first quarter guidance.

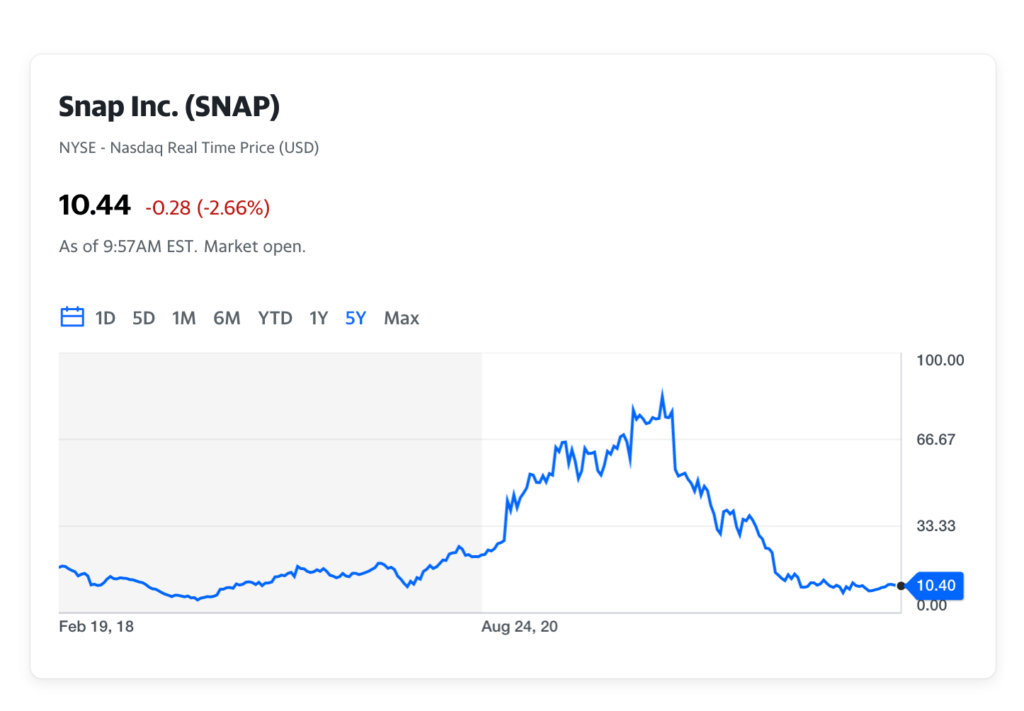

Snap shares fell 4.7% on Thursday following its investor day. Still, shares are up about 20% so far this year. From its record high reached in 2021, shares are down about 85%.

Though generative AI has surged in popularity in recent months — and competitor Meta Platforms (META) has been aggressively pursuing its own metaverse-centered vision of the future — Snap co-founder and CEO Evan Spiegel is sticking to his guns.

“Augmented reality has the potential to make nearly everything in our daily lives better, whether discovering the storied history of your neighborhood, learning to play piano, re-decorating your living room or practicing your football spiral,” he said.

Snap CFO Derek Andersen emphasized the difficulties of the macroeconomic climate, and how it’s affected Snap’s top and bottom line. He acknowledged in the Q&A session the company needs to boost its top line to set things right, but added the company is focusing on what it can control, rather than the macro and privacy changes that have rattled it over the last year and a half.

Last month, Snap guided to current quarter revenues dropping between 2%-10% from a year ago.

“We’re going to stay focused on the inputs we can control and hope that the environment cooperates,” he added.

Looking at the near-term, Andersen expressed optimism about the company’s direct response ads business and ability to monetize its AR capabilities.

In the medium-term, plans include leveraging and growing its subscription service, Snapchat Plus.

“We want to prioritize the opportunities we’re going to go after,” Andersen said. “We want to fully fund those priorities, then it’s all about execution.”

Source: finance.yahoo.com

EV stocks have multiplied in Tesla’s (TSLA) wake and as electric cars look to go mainstream — but not all are created equal. Some car stocks are more ready than others for an electric future. Here are the top-rated EV makers and EV-related plays.

The charts of most EV stocks remain under strain. Broadly, both established automakers and startups are a speculative bet on the growth of electric vehicles, itself seen as a nascent field. Growth stocks led the bear market in 2022 due to rising inflation and interest rates.

It’s hard to find an EV stock with a good mix of fundamentals and technicals right now. Not including Tesla, these are our picks based on EV sales, strategy and growth plans.

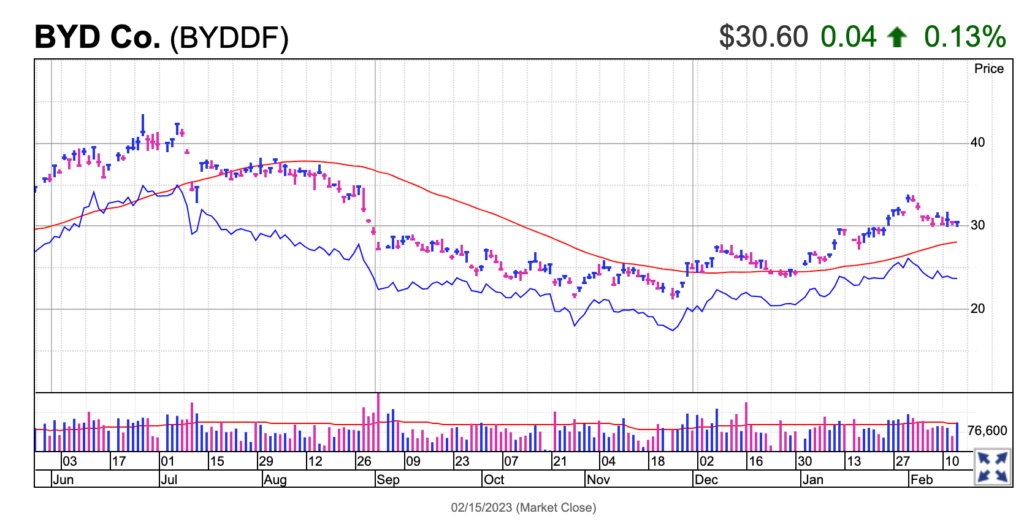

BYD (BYDDF) earns an EPS Rating of 83 and RS Rating of 75, both out of a best-possible 99. The 75 RS Rating means that BYDDF stock has outperformed 75% of all stocks in IBD’s database over the past year. Shares trade over the counter in the U.S.

BYD stock is working on a long, deep cup base with a buy point of 43.71. Shares appear to be working on a handle above the 200-day line that might be fractionally too low to be a proper handle.

In early 2022, China auto giant BYD (for Build Your Dreams) switched to producing only all-electric vehicles (also known as battery electric vehicles, or BEVs) and plug-in hybrid electric vehicles (PHEVs).

BYD sold more than 1.85 million electric cars in 2022, including hybrids. In 2022, as well as in 2021, BYD more than tripled EV sales.

Most of BYD’s sales are still on home turf. However, it has a big international expansion underway, including the U.S., Europe and markets in Asia beyond China.

The company supplies batteries, including to Tesla, and makes its own chips. That has underpinned BYD’s rapid expansion in 2021 and 2022.

Including PHEVs, BYD has surged past Tesla sales. BYD is closing the gap with Tesla on BEVs as well. In the minus column, investing legend Warren Buffett continues to cut his stake in BYDDF shares.

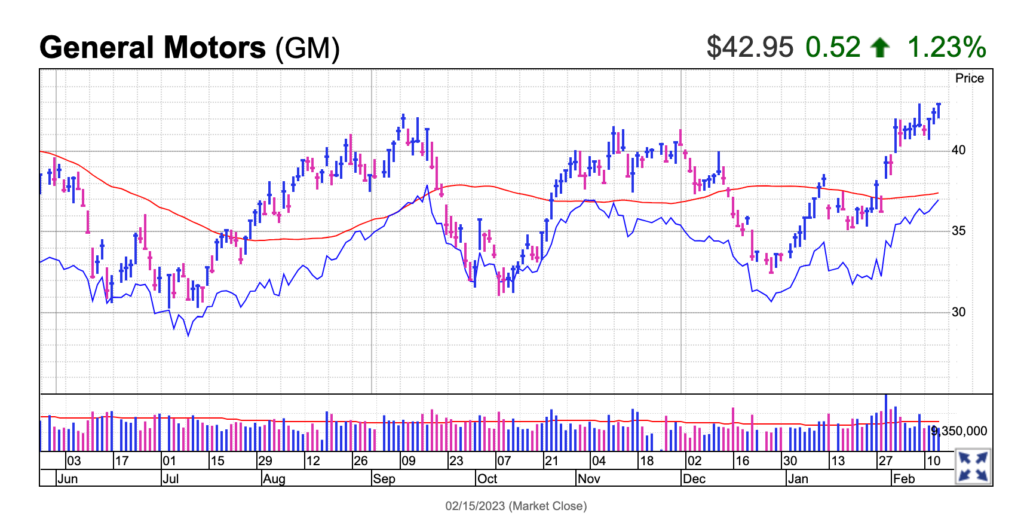

General Motors (GM) has a Composite Rating of 84, EPS Rating of 83 and RS Rating of 71. GM stock is well above the 21-day moving average, as well as longer-term averages, after better-than-expected earnings and strong outlook.

GM stock cleared a 41.68 buy point Feb. 13. It’s within the 5% chase zone, which goes to 43.76.

Along with earnings Jan. 31, GM CEO Mary Barra announced a $650 million investment in Vancouver, British Columbia-based Lithium Americas (LAC). Lithium is a key EV battery material.

Traditional automakers continue ramping up on electric vehicles (EVs), away from gas and diesel cars. Through 2025, General Motors is spending $35 billion to develop electric and autonomous vehicles. It aims to launch 30 new EVs around the world by then. By 2030, GM expects as much as half its global sales to be battery-powered cars.

In the minus column, GM has struggled to ramp up production of luxury new EVs, including the Hummer truck and Lyriq SUV, though its older-generation Chevy Bolt EV model is selling well.

Three all-new EV models are due in 2023 from GM’s mass-market Chevrolet brand. Those new EVs include all-electric versions of the Chevrolet Silverado, Chevrolet Blazer and Chevrolet Equinox. The Chevy Silverado pickup is GM’s top-selling model. The Blazer and Equinox are popular SUVs.

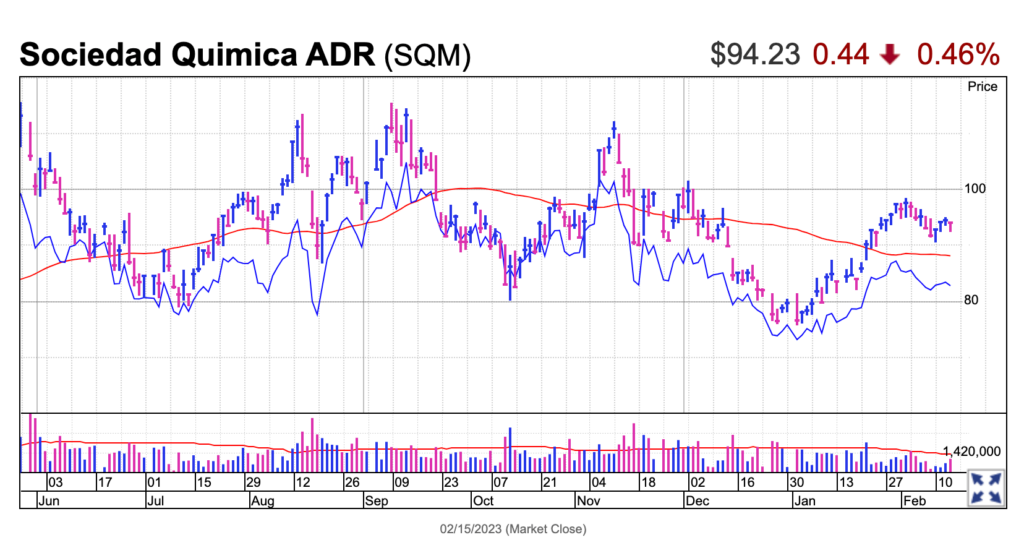

Sociedad Quimica y Minera (SQM), also known as SQM, carries a 93 Composite Rating, 96 EPS Rating and 77 RS Rating.

SQM stock has a double-bottom base with a 112.45 buy point, but is carving a handle that could lower the official entry to 98.76.

Chile’s SQM is riding the global adoption of electric vehicles, which use lithium batteries. Demand for lithium, a critical EV battery material, has been outpacing supplies. That has sent lithium prices soaring.

SQM also produces iodine and potassium, used in X-rays and fertilizers respectively.

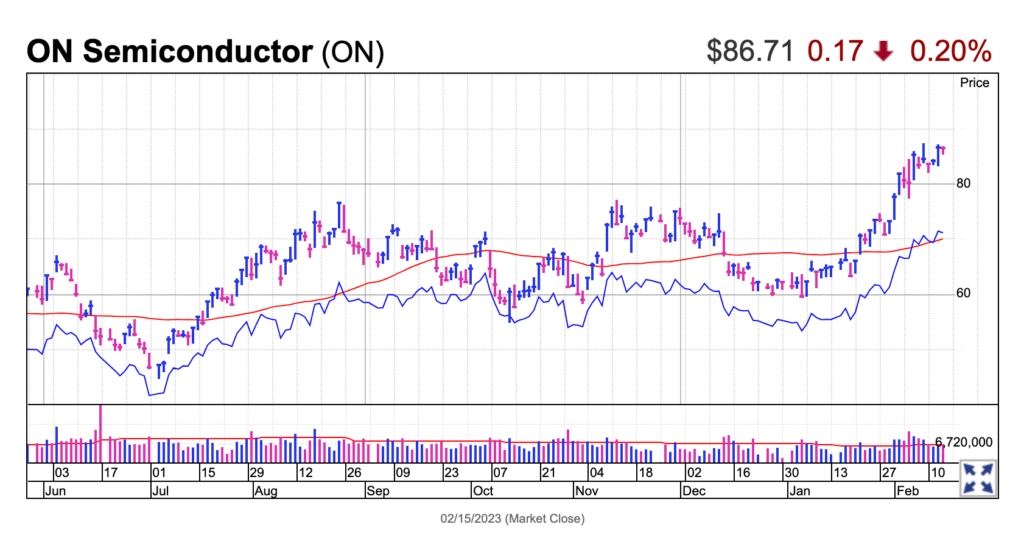

Onsemi (ON) carries a Composite Rating of 95, EPS Rating of 93 and RS Rating of 94. On Feb. 1, ON stock broke out of a cup base with a buy point of 77.38.

Shares have kept rising and are now extended, meaning they are not within the proper 5% buy range.

The chipmaker beat estimates for the fourth quarter Feb. 6, but fell on weak guidance. ON stock remains above the buy point.

The secular megatrends of electric vehicles, advanced driver-assistance systems, alternative energy and industrial automation drove Onsemi’s revenue growth, CEO Hassane El-Khoury said in a news release.

Earlier in January, Onsemi entered into a strategic partnership with Volkswagen (VWAGY) to supply inverters for use in a next-generation VW electric platform.

Onsemi also provides technology for fast charging electric vehicles.

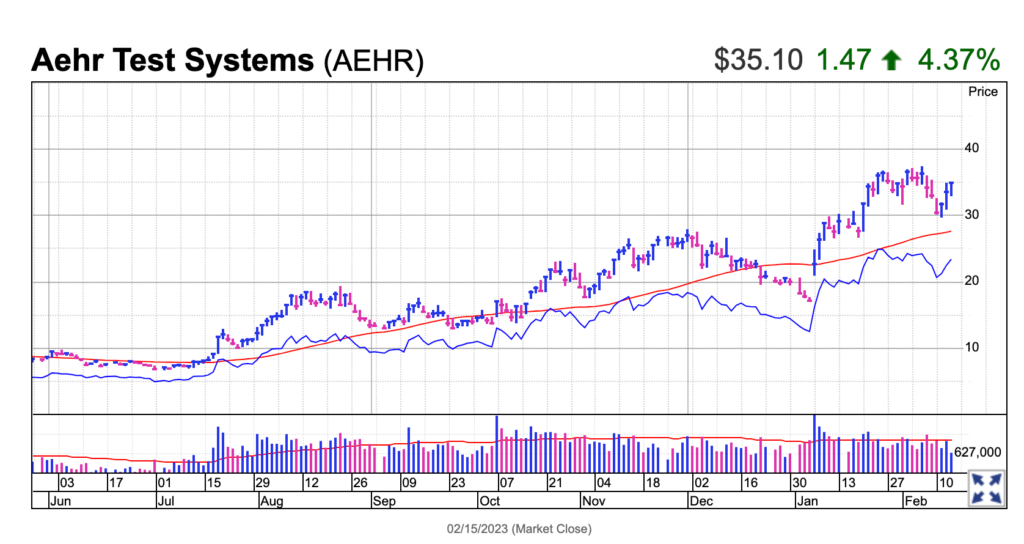

Aehr Test Systems (AEHR) carries a Composite Rating of 99, EPS Rating of 78 and RS Rating of 99, all out of a best-possible 99.

AEHR stock has had big swings in the past several months, usually up.

Semiconductor equipment maker Aehr offers products for testing logic, optical and memory integrated circuits, as quality and reliability needs increase. The Fremont, Calif.-based company has been growing revenue by double and triple digits.

It touts strong demand for gear to test silicon carbide power chips used in electric vehicles.

The demand for silicon carbide (SiC) EV chips is seen increasing exponentially in the decade ahead.

In addition to EVs, silicon carbide chips have bright prospects in industrial, solar, wind, and EV charging infrastructure markets.

Companies with two characteristics generally make the best candidates for stocks to buy and watch, according to CAN SLIM guidelines. First, they need a strong track record of earnings growth. Second, they should be technically strong and be shaping bullish chart patterns.

Most of the new EV startups have neither. Those EV stocks include Fisker (FSR), Canoo (GOEV), Faraday Future (FFIE), Lordstown (RIDE) and Xos (XOS). In fact, many of the startups aren’t producing electric vehicles yet.

However, Lucid Motors (LCID) and Rivian Automotive (RIVN) have begun selling EVs.

Meanwhile, Chinese EV startups like Nio (NIO), XPeng (XPEV) and Li Auto (LI) sell tens of thousands of vehicles, but aren’t yet or aren’t consistently profitable.

Then there are legacy auto giants like General Motors (GM), Ford (F), Volkswagen (VWAGY) and China’s BYD Co. (BYDDF), all transforming into EV powerhouses.

The growing universe of EV stocks doesn’t end with carmakers. A constellation of other companies provide car batteries, car charging stations, electric motors and other EV-related products. Among them are ChargePoint (CHPT), EVgo (EVGO), Blink Charging (BLNK) and Wallbox (WBX).

Hyliion (HYLN) is developing electric powertrains for big-rig trucks. Romeo Power (RMO) makes battery packs for commercial EV fleets. QuantumScape (QS) targets solid-state lithium metal batteries.

Magna (MGA) supplies battery enclosures and e-drive gearboxes. It’s also an EV contract manufacturer.

Source: finance.yahoo.com

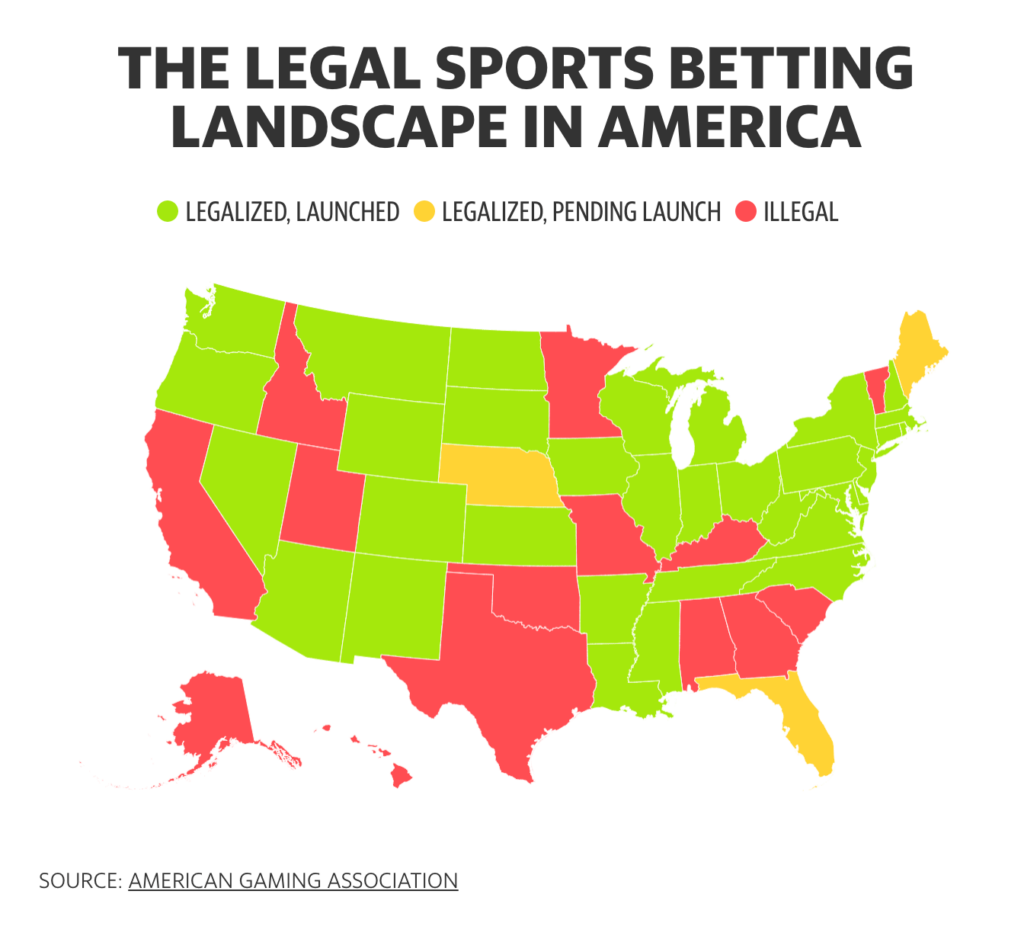

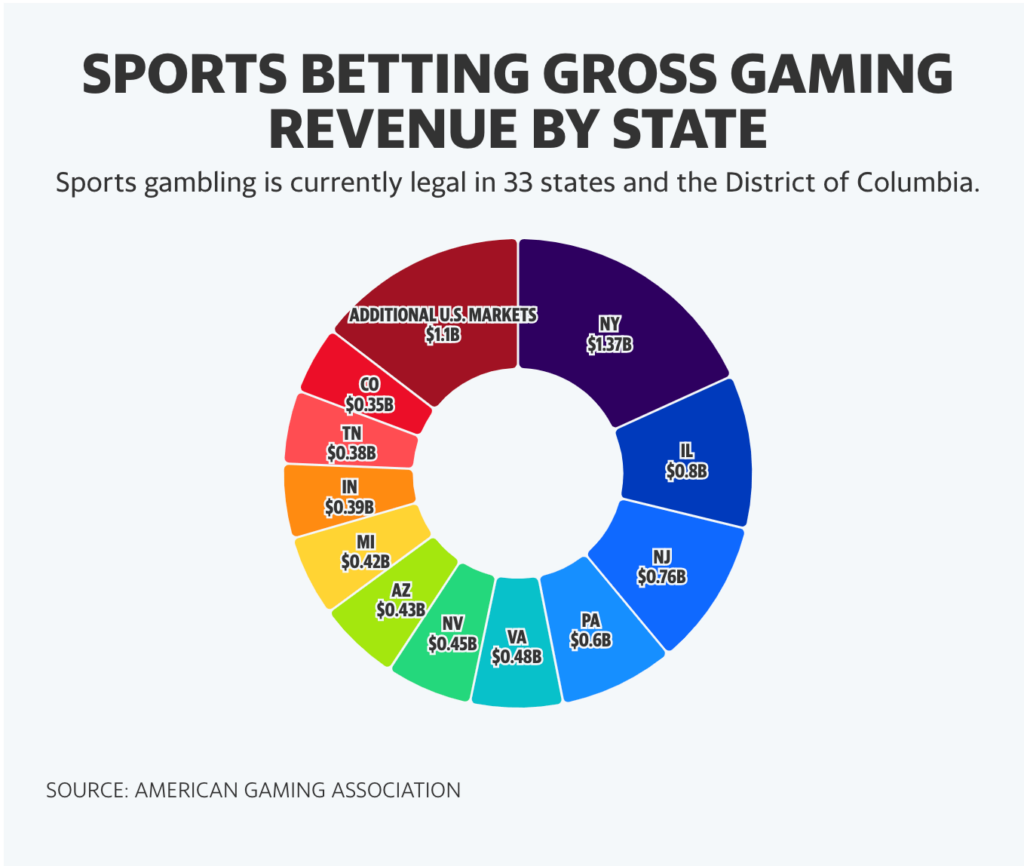

Sports betting broke records in 2022, according to new data released by the American Gaming Association (AGA).

According to the AGA findings, sports betting gross game revenue hit a record $7.5 billion last year, a nearly 75% increase from 2021, while total gross gaming revenue (GGR), which accounts for all legal gambling, exceeded $60 billion for the first time ever.

“Our industry significantly outpaced expectations in 2022,” AGA President and CEO Bill Miller said. “Simply put, American adults are choosing casino gaming for entertainment in record numbers, benefiting communities and taking market share from the predatory, illegal marketplace.”

Increased legalization, including the addition of four new mobile gambling states and the maturation of previously legal markets, drove the higher revenue numbers, according to the AGA.

Currently, sports gambling is legal in 33 states and the District of Columbia while eight states have active legislation to legalize it. Texas is among those states and would become the largest destination for legal sports betting if its bill passes.

That momentum hasn’t entirely gained steam across the U.S., though: In 2022, California, one of the sports gambling industry’s most sought-after markets, failed to pass legislation to legalize sports gambling.

“Legalization has definitely slowed down,” topld Christopher Lynch, Citizens Capital Markets head of gaming leisure investment banking. “That’s just a function of how many states have legalized. We’re at about 35 states that have legalized in some form or fashion. I think that’s gonna continue to remain a focus, with Texas being the biggest focus.”

While sports betting led the largest yearly increase in GGR, which is the amount casinos earn prior to paying state taxes, other sectors of the gaming industry also significantly increased in 2022, according to the report.

Slot revenue ($34.19 billion) increased marginally, while table game revenue ($10 billion) and iGaming revenue ($5.02 billion) both experienced double-digit growth from 2021.

Over the past year, Wall Street has been focused not just on the eye-popping revenue numbers in the gambling space but also on how much operators are spending to acquire their boosted revenue.

Marketing spend in sports gambling has hampered many casino operators from posting profitable quarters in their online gambling units amid a broader trend of risk-off trades in markets.

Online gambling operator DraftKings (DKNG), which reported an Adjusted EBITDA loss of $326.29 million in the fourth quarter of 2021, is set to report earnings for the fourth quarter of 2022 on Thursday after the market close.

Wall Street is expecting DraftKings to report a loss of $112.42 million.

“The outlook’s all about: Are they able to go and be able to prove to the Street that they can actually generate and grow this business profitably?” told Jed Kelly, Oppenheimer managing director of equity research for consumer internet. “They’ve got a pretty good outlook for state launches this year, so that should allow them to leverage their advertising spend better.”

Source: finance.yahoo.com

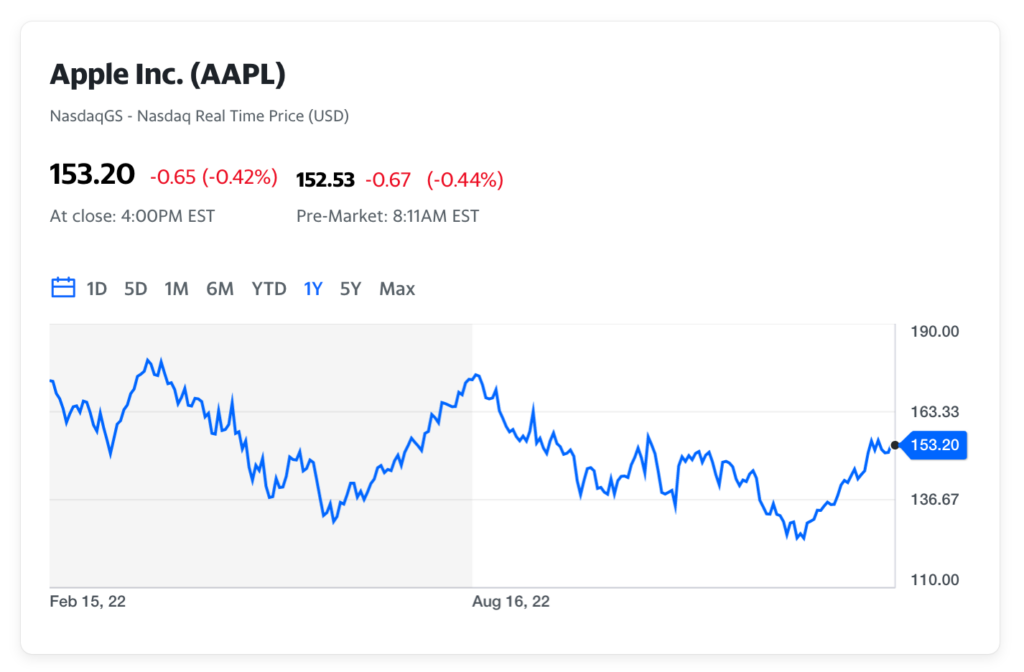

There may still be life for Apple’s long-rumored foldable iPhone. On Monday The U.S. Patent Office published that it awarded the tech giant a patent for a display with touch sensors. Apple (AAPL) specifically refers to a foldable electronic device in the patent’s abstract.

UBS analyst David Vogt says that while there’s no indication that we’ll see a foldable iPhone this year, the introduction of such a product in the future could help boost iPhone sales around the world.

“We believe that a foldable iPhone model could lead to an uptick in consumer purchasing and upgrade rate within the smartphone segment,” Vogt wrote in a note to investors. “If a foldable device compresses the upgrade rate for iPhones or attracts ‘switchers’ from the Android ecosystem, iPhone unit growth could come in above our 238 million estimate in [fiscal 2024] given an installed base of roughly 1.2 billion iPhones and roughly 1.3 billion smartphones shipped a year.”

Rumors of a foldable iPhone have been circling for years. In April 2022, FT International analyst Ming-Chi Kuo predicted that the folding smartphone would hit stores in 2025, potentially as a foldable iPhone/ iPad hybrid.

In 2021, Bloomberg’s Mark Gurman, who is known for accurately reporting Apple products before the company announces them, said it would be two to three years before the company launches a foldable device.

Apple rival Samsung already has two foldable smartphones: the Galaxy Z Fold 4, which has a vertical crease down the center of the display that makes it fold like a book, and the Galaxy Z Flip 4, which features a horizontal crease that allows it to fold like a makeup compact. Both phones, however, are marketed as premium devices, with the Z Flip 4 starting at $999, and the Z Fold 4 starting at $1,799.

Introducing foldable smartphones, however, could help goose Apple’s iPhone sales at a time when global phone sales are coming off of pandemic highs. According to IDC’s Worldwide Quarterly Mobile Phone Tracker, smartphone shipments fell 11.2% in 2022. Apple, alone, saw a 14.9% decline in Q4.

Apple’s iPhone revenue in Q1, which includes sales during the holiday, meanwhile, missed analysts’ expectations, coming in at $65.7 billion versus the $68.3 billion Wall Street was anticipating.

Still, the smartphone maker, like other tech giants, regularly files for and receives patents for technologies that never reach consumers. In other words, a folding iPhone could just be something the company is taking seriously enough to patent, but not necessarily make. And while iPhone sales did decline in Q1, much of that was seemingly tied to manufacturing issues caused by COVID lockdowns and worker protests in China.

What’s more, as Vogt points out, in a survey of 7,000 smartphone users in the U.S., U.K., and China, UBS found that a folding phone was the least important feature customers were looking for in a new handset.

Despite that, Apple could still launch a foldable phone in the coming years as the technology becomes more affordable for consumers. Or maybe the company will just end up abandoning our phones for the metaverse. Who knows?

Source: finance.yahoo.com