Is Apple Stock A Buy After December-Quarter Earnings Miss?

Consumer electronics giant Apple (AAPL) has seen its sales lowered by supply constraints and weakening macroeconomic conditions, which have rocked Apple stock. Still, many investors might be wondering if AAPL stock is a buy right now.

Apple Stock News: iPhone 14 Sales

On Sept. 7, Apple introduced its third-generation 5G smartphones, the iPhone 14 series. It also debuted its Apple Watch Series 8 smartwatches and second-generation AirPods Pro wireless earbuds. Apple stock rose 0.9% on the news.

Analysts praised the innovative new devices but some worried that the premium products would be a tough sell in the current economic climate.

However, demand for the high-end iPhone 14 Pro models has been strong, while sales of the regular models have disappointed.

On Nov. 6, Apple warned that a Covid outbreak at a factory in China would limit the availability of iPhone 14 Pro and Pro Max handsets in the holiday season. The Foxconn-owned factory was “operating at significantly reduced capacity” because of Covid restrictions, Apple said. The factory later saw worker protests that turned violent, according to news reports.

On Feb. 2, Apple said the production disruptions significantly impacted its iPhone sales in the December quarter.

Apple Opportunities For Growth

With the iPhone business maturing, investors are wondering what the next big growth driver will be for Apple stock.

Recently, two businesses have given Apple’s sales and profits a boost: services and wearables.

In the December quarter, Apple’s services revenue rose 6% year over year to $20.77 billion. Meanwhile, its hardware sales declined 8% to $96.39 billion. Services include the App Store, AppleCare, iCloud, Apple Pay, Apple Music, Apple TV+, Apple Arcade and other offerings.

In late October, Apple raised prices for the first time on its Apple Music and Apple TV+ services. It also hiked the price for its Apple One services bundle.

Meanwhile, Apple is facing antitrust scrutiny in the U.S., Europe and Asia for its App Store policies, including its 30% commission fee.

Apple Product Rumors Persist

Apple’s Wearables, Home and Accessories unit saw sales drop 8% to $13.5 billion in the December quarter amid product shortages. This unit includes wearables like the Apple Watch, AirPods wireless earbuds and Beats headphones. It also contains the Apple HomePod wireless speaker and other miscellaneous gadgets.

News leaks suggest that Apple will announce a headset for virtual reality and augmented reality in 2023. The computer headset could be a driver of Apple stock, analysts say.

Meanwhile, speculation continues that Apple is looking to make a self-driving electric car.

Apple Earnings: Miss and Guide Down

Late on Feb. 2, Apple missed Wall Street’s targets for its fiscal first quarter and guided lower for the current period. Still, Apple stock rose 2.4% in the next trading session.

Apple earned $1.88 a share on sales of $117.2 billion in its fiscal first quarter ended Dec. 31. Analysts polled by FactSet had expected earnings of $1.94 a share on sales of $121.4 billion. On a year-over-year basis, Apple earnings fell 10% while sales dropped 5%.

For the March quarter, Apple expects sales to decline about 5%, vs. Wall Street’s estimate for a drop of less than 1%.

In the December quarter, Apple’s iPhone revenue sank 8% to $65.8 billion. Wall Street was looking for $68 billion. Smartphones accounted for 56% of the company’s total sales in the period.

Meanwhile, Apple’s Mac computer sales tumbled 29% to $7.7 billion. However, Apple’s iPad business bucked the downtrend, growing 30% to $9.4 billion in the holiday quarter.

The company’s next earnings report won’t be until late April.

Apple Stock Retreats From Record High

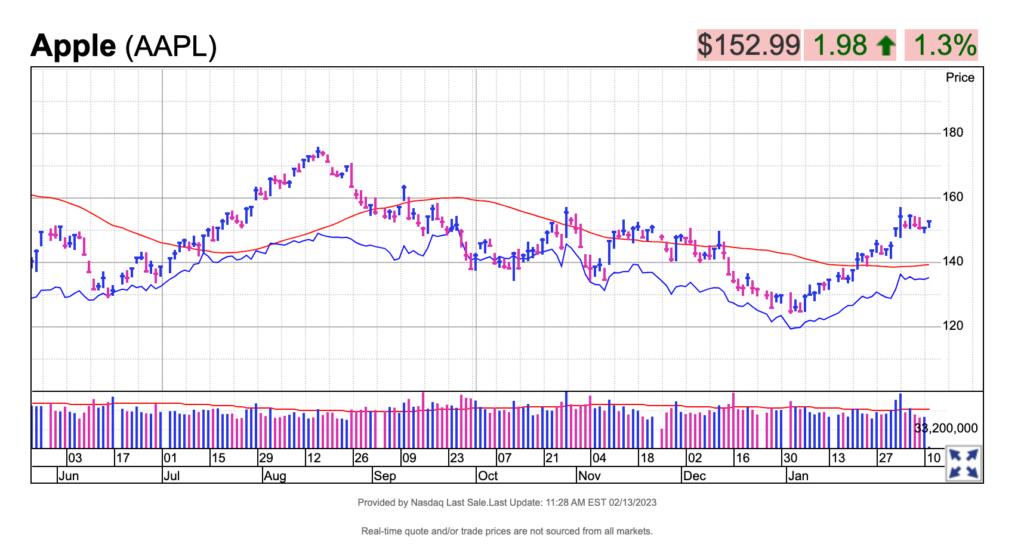

In January 2022, Apple hit a market value of $3 trillion when its shares reached 182.86. It was the first company to reach a market capitalization of $3 trillion.

It notched a record high of 182.94 before pulling back. AAPL stock trended lower in the weeks that followed and it attempted to rally several times last year.

Apple’s Storied History

Apple has been an American success story several times over. First, it ignited the personal computer revolution in the 1970s with the Apple II. Then it reinvented the PC in the 1980s with the Macintosh.

Co-founder Steve Jobs returned to run Apple in 1997 and oversaw a winning streak of innovations that included the iMac, iPod, iTunes, iPhone, iPad and the App Store.

The biggest driver of Apple’s modern success is the iPhone. The game-changing smartphone, which debuted in 2007, sparked years of massive growth and created a loyal base of customers willing to buy Apple products and services.

Exclusive Apple Stock Ratings

After hitting its record high at the start of 2022, Apple stock pulled back as much as 32%.

AAPL stock has an IBD Relative Strength Rating of 37 out of 99. The Relative Strength Rating shows how a stock’s price performance stacks up against all other stocks over the last 52 weeks.

Apple stock has an IBD Composite Rating of 61 out of 99, according to the IBD Stock Checkup tool. IBD’s Composite Rating combines five separate proprietary ratings of fundamental and technical performance into one easy-to-use rating. The best growth stocks have a Composite Rating of 90 or better.

Also, Apple ranked No. 5 on IBD’s 2022 100 Best ESG Companies list. ESG is short for environmental, social and governance.

AAPL Stock Technical Analysis

For the past 58 weeks, AAPL stock has been consolidating with buy point of 183.04, according to IBD MarketSmith charts. It ended the regular session Feb. 10 at 151.01.

In a positive sign, Apple stock has been trading above its 50-day moving average line, as well as its 200-day line. Also, its relative strength line has been rising lately as it outperforms the S&P 500 this year.

Apple stock has an IBD Accumulation/Distribution Rating of A-, indicating institutional buying of shares.

Source: finance. yahoo.com