Cryptocurrencies at crossroads after annus horribilis

To borrow from Britain’s Queen Elizabeth, 2022 is not a year on which the cryptocurrency world shall look back with undiluted pleasure.

Crashes, contagion, collapses came in such quick succession that investors were, towards the end of the year, asking serious existential questions.

After all, the largest cryptocurrency, bitcoin, has not kept its head above water for more than a week at a time, and is down about three-quarters from last November’s $69,000 peak.

The market value of the 22,000-odd tokens and coins is now at less than a third of the peak $3 trillion in November 2021, and many of them are comatose, if not outright dead.

That’s been a brutal reality check for an industry that kicked 2022 off with dreams of widespread mainstream institutional adoption, of bitcoin supplanting even gold as the world’s inflation hedge, as well as endorsements from the likes of Tesla Inc chief Elon Musk and the wild celebration of billion-dollar non-fungible tokens.

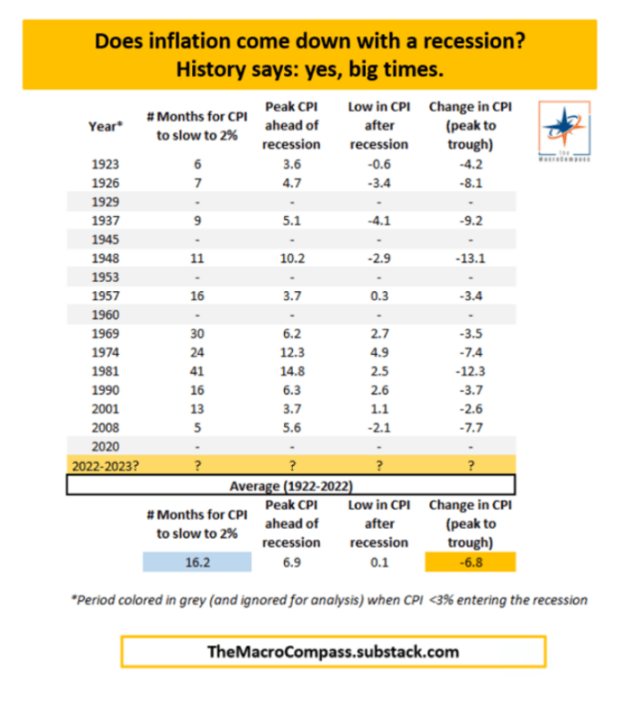

Not only did cryptocurrencies get slammed by the Fed’s uber hawkishness, their slide also triggered the crash of a stablecoin called TerraUSD, that then wrought a ‘Lehman moment’ as funds and brokers such as Celsius and Voyager went bankrupt.

What some saw as the final nail in the crypto coffin was the collapse of Sam Bankman-Fried’s FTX exchange last month.

WHY IT MATTERS

Unlike in 2017, when bitcoin crashed just as spectacularly, there are far fewer diehard crypto buffs predicting a bounce this time.

Rather, 2022 has become the “I-told-you-so” case for regulators, who’ve largely maintained an arm’s length from the crypto world or even banned trading in cryptocurrencies.

The European Central Bank reckons bitcoin’s modest bounce this month is an “artificially induced last gasp before the road to irrelevance”.

Indeed, the one extenuating factor this year has been how mainstream finance has mostly escaped contagion. The excesses, the uncontrolled lending and fudging of billions of dollars have happened overwhelmingly within the crypto ecosystem.

At the same time, the idea that decentralised finance and private crypto coins can operate in the shadows of the traditional banking system, and thrive, now appears delusional.

As retail and institutional investors lose trust in crypto operators, a host of policymaker voices and even crypto barons are joining U.S. SEC Chair Gary Gensler in calling for regulation.

WHAT DOES 2023 HOLD?

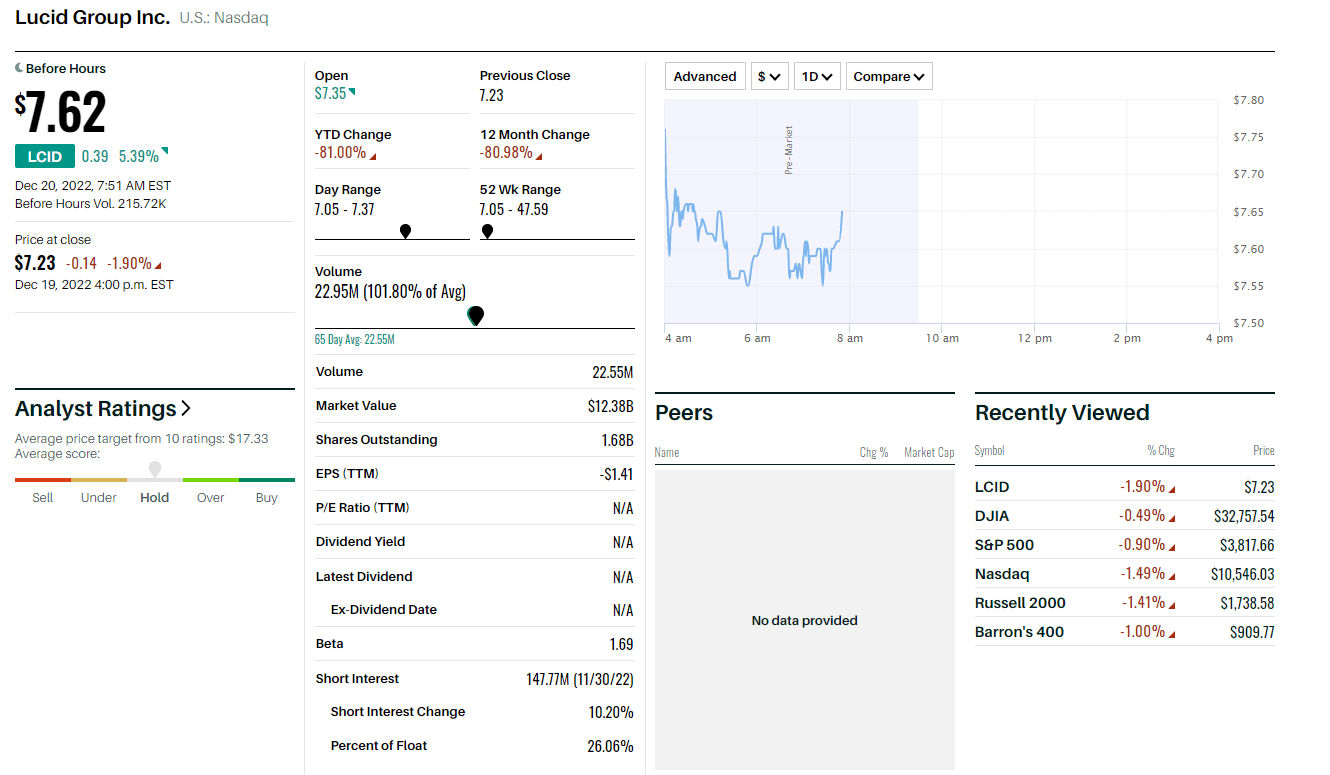

UBS strategist James Malcolm points to the increasing correlation between cryptocurrencies and micro-cap U.S. stocks as testament to how bitcoin and other tokens could survive on the fringes, as a niche, diverse asset in investment portfolios.

“It’s wrong to say this thing is going to curl up and die completely because there are elements of it which can be useful in other areas, and there is probably a modest cryptocurrency market which will continue to thrive on the margin of financial markets,” he says.

Yet, the sort of regulation that investors need to feel safe dealing with crypto brokers and exchanges, be it transparency or capital adequacy, could take months, if not years to implement.

“Some asset managers are looking at this as a 10-15 year journey to digital assets becoming fully mainstream,” Morgan Stanley said in a note summarising the bank’s discussions with the crypto industry.

Next year could meanwhile see traditional financial world use the crypto malaise to up its game: snap up platforms and assets in the blockchain world, issue tokenised bonds and stocks or maybe even roll out more central bank digital currencies.

As UBS’s Malcolm says, it might just go to show that crypto was meant to be more “an evolutionary than a revolutionary development in financial markets.”

Source: reuters.com