While the big-name stocks may get the attention and the headlines, they’re not the only game in town. And sometimes, the market giants aren’t even the best place to turn for solid returns on that initial investment. There are small- to mid-cap stocks in the market that can present an unbeatable combination for income-minded investors: share appreciation and high-yielding dividend returns.

These stocks, however, can go undercover, slipping under investors’ radar, for numerous reasons, everything from living in unusual business niches to consistent failure to post profits, but sometimes the reason can be much more mundane: they’re just smaller companies. It’s inevitable that some sound equities will get overlooked.

Crescent Capital BDC, Inc. (CCAP)

We’ll start with Crescent Capital, a BDC firm that is part of the larger Crescent Group. Crescent Capital BDC offers a range of financial services to mid-market private enterprises, the type of companies that has long been drivers of the overall US economy but are frequently too small to access extensive credit and financing services from the traditional banking sector. Crescent serves this base through loan origination, equity purchases, and debt investments; the company’s portfolio totals over $1.29 billion in fair value and leans heavily toward unitranche first liens (62.7%) and senior secured first lien (25.4%).

Crescent Capital will be reporting its Q4 financial results in February; analysts are forecasting bottom-line earnings of 44 cents per share. It’s interesting to note that the company has beaten the EPS guidance by approximately 21% in each of the last two quarters reported. In the most recent, 3Q22, the company showed total investment income of $29 million, up 13% year-over-year, and a net investment income of $16 million, up 26% y/y. Net investment income per common share for Q3 came to 52 cents, compared to the 45 cents reported in the prior-year quarter.

Back in November, Crescent Capital declared its Q4 dividend, which was paid out this past January 17. The payment was set at 41 cents per common share, and the annualized rate of $1.64 gives a yield of 11.5%. This yield is nearly 5 points higher than December’s 6.5% annualized rate of inflation, and nearly 6x the average dividend paid by S&P-listed companies. It should be noted that, since Q4 of 2021, Crescent Capital has, in addition to its 41-cent regular quarterly dividend, also consistently paid out a 5-cent special dividend.

The Fed is committed to fighting inflation through increased interest rates, and Raymond James’ 5-star analyst Robert Dodd sees this as a net gain for Crescent. He writes, “Rising base rates should benefit earnings in 4Q22. The earnings benefit from higher rates is the plus side of inflation, the downside is margin pressure, and its impact on some portfolio companies. We do expect portfolio deterioration, and rising non-accruals as we head into the back end of the year (for all BDCs), but we believe that rate benefits will overwhelm the potential negative impact of non-accrual increases in the near/medium term.”

At the bottom line, Dodd says, “We see an attractive risk/reward, with positive rate sensitivity and strong credit quality — for a BDC trading at a material discount to current NAV/Share, and at a discount multiple to its peer group.”

Taking this forward, Dodd gives CCAP shares an Outperform (i.e. Buy) rating, and his price target, set at $18, implies that a one-year gain of ~25% lies ahead. Based on the current dividend yield and the expected price appreciation, the stock has ~36% potential total return profile.

Overall, this BDC has picked up 3 recent analyst reviews – and they are all positive, supporting a unanimous Strong Buy consensus rating. The shares are priced at $14.42, with a $17.67 average price target suggesting ~22% upside potential over the next 12 months.

Piedmont Office Realty Trust (PDM)

From the BDC world we’ll shift our focus to a real estate investment trust (REIT), another leading sector among dividend payors. Piedmont Office is a ‘fully-integrated and self-managed’ REIT, focusing on the ownership and management of high-end, Class A office buildings in high-growth Sunbelt cities such as Orlando, Atlanta, and Dallas. The company also has a strong presence in the northeast, in Boston, New York, and DC. In addition to existing office space, Piedmont has ownership of prime land plots, totaling 3 million square feet, for build-to-suit or pre-leased projects.

Come February 8, Piedmont is scheduled to release its 4Q22 and FY2022 results. The company has already published full-year guidance of $73 million to $74 million in net income, and core funds from operations per diluted share of $1.99 to $2.01. Keeping these numbers in mind, we can look back at 3Q22, the last quarter reported.

In that quarter, the company had a net income of $3.33 million; the first three quarters of 2022 saw a net income of $71.26 million. Net income per share for the quarter came to 3 cents, missing the 6-cent forecast by a wide margin. The company’s core funds from operations – a key measure for dividend investors, as it funds the payments – for Q3 remained in line with the prior-year results, at $61.35 million. Core FFO came to 50 cents per share in 3Q22.

Even though Piedmont’s income has fallen over the past year, the company had no problem covering the 21 cent common share dividend payment. The dividend was declared in October and paid out on January 3 of this year. At 84 cents per common share, the annualized payment yields 8.5%, beating inflation by a solid 2 points. Piedmont has a long history of keeping its dividend reliable; the company has paid out a regular quarterly div since 2009, and has maintained the current payment since 2014.

Assessing the outlook for Piedmont, Baird analyst Dave Rodgers explains why this REIT remains a top pick: “We believe PDM is among the best positioned to outperform during 2023. The current space market is denoted by Office leasing activity concentrated across small-to-mid-sized tenants supporting 1) PDM’s focus on value-add and asset repositioning; 2) its 14ksf average in-place tenant size; and 3) its 8ksf average size for 2023 lease expirations.”

“While we expect leasing to be an opportunity for PDM, the bigger catalyst, in our view, is the likely recovery in the investment sales market —driving PDM’s return to its capital recycling strategy and the accretive exit of NYC, Boston and Houston in the near term,” Rodgers added.

Rodgers goes on to give PDM shares an Outperform (i.e. Buy) rating, with a price target of $13, indicating his confidence in a 28% upside on the one-year horizon.

This stock holds a Moderate Buy rating from the analyst consensus, based on 3 recent reviews that include 2 Buys and 1 Hold. The average price target of $13.67 suggests a 35% upside potential from the current trading price of $10.12.

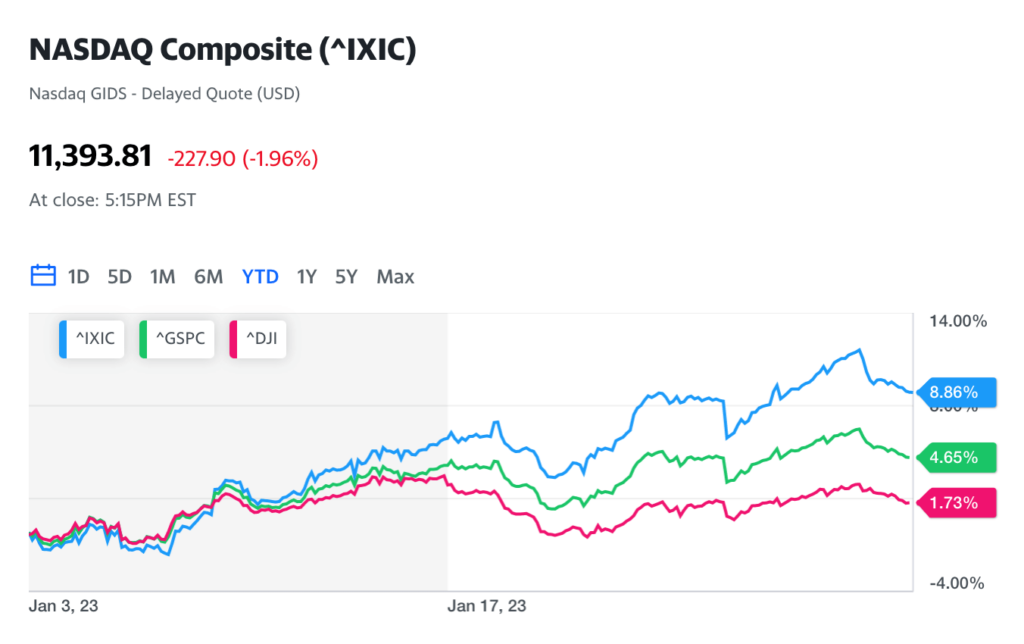

Source: finance.yahoo.com