Netflix says it ‘updated’ new password sharing policies that had users melting down

Netflix and chill (out), password sharers.

After intense backlash surrounding what appeared to be the first signs of the company’s upcoming password sharing crackdown, Netflix (NFLX) clarified no official announcements have been made outside of the current test countries.

“For a brief time last Tuesday, a help center article containing information that is only applicable to Chile, Costa Rica, and Peru, went live in other countries. We have since updated it,” a Netflix spokesperson told.

Last week’s updates appeared to show the company would require users to identify a “primary location” for all accounts that live within the same household. News which had users suggesting this would be a bridge too far, and threatening to leave the platform as a result.

Users would then need sign into the home Wi-Fi of the primary location at least once every 31 days to ensure their device is not blocked. Temporary codes would need to be used for traveling members, which would only remain valid for seven consecutive days

Netflix said it would use information such as IP addresses, device IDs, and account activity to determine whether a device signed into the account is connected to the primary location.

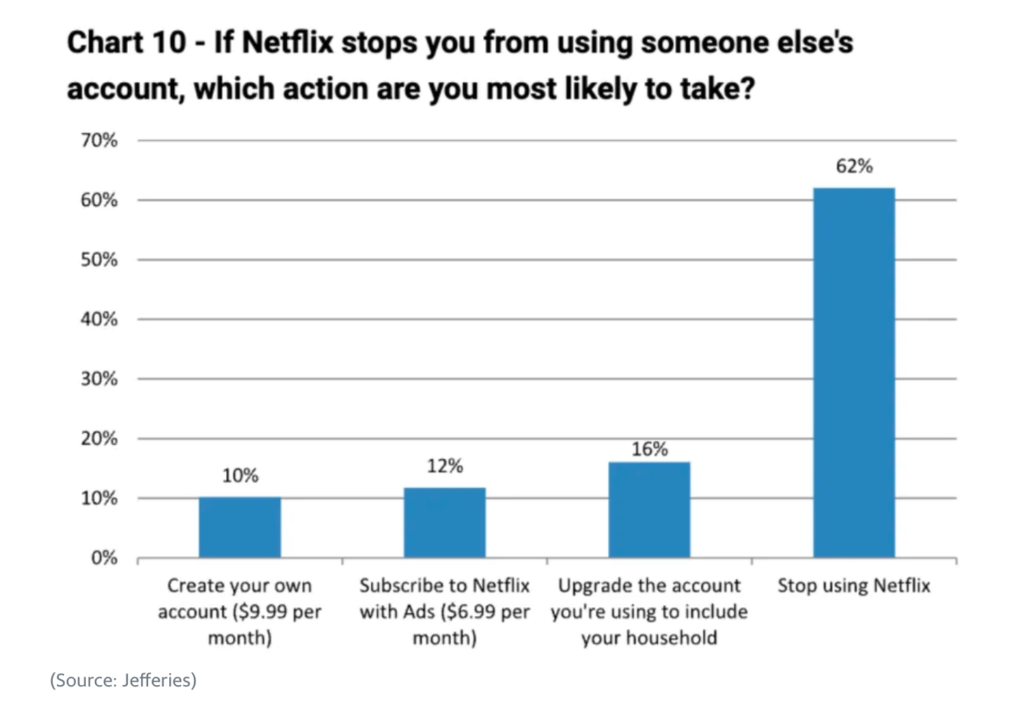

In a recent survey, investment firm Jefferies highlighted concerns surrounding the company’s crackdown on password sharing, particularly among the account freeloaders Netflix hopes to convert.

According to lead analyst Andrew Uerkwitz, about 62% of the 380 Netflix password borrowers surveyed said they would stop using Netflix once the crackdown takes effect.

Only 10% of those polled said they would move to create their own account for $9.99 a month, hinting password borrowers don’t see enough value in the platform. The survey also suggested competitors could greatly benefit from Netflix’s crackdown.

Some 35% of respondents said they can replace Netflix with another service, while another 31% added they don’t enjoy the content enough to justify paying for it.

When asked which platforms users would use more frequently if they eliminated Netflix, the top streaming alternatives included Amazon Prime Video (42%), Hulu (35%), and Disney+ (26%).

In its quarterly letter to shareholders published last month, Netflix said it would be intensifying its push to combat password sharing in Q1, although the streamer did not provide details on when exactly that would occur and what countries would be impacted.

“Later in Q1, we expect to start rolling out paid sharing more broadly. Today’s widespread account sharing (100M+ households) undermines our long term ability to invest in and improve Netflix, as well as build our business,” the company wrote.

Netflix’s password crackdown, coupled with its recently launched ad-supported tier, have been looked at as meaningful profitability drivers, especially as competition within the streaming space escalates: “As always, our north stars remain pleasing our members and building even greater profitability over time.”

Netflix reported subscriber net additions of 7.66 million in Q4, above company guidance for 4.5 million amid a slew of high-profile and record-breaking content releases, including “Glass Onion,” “Troll,” “All Quiet on the Western Front,” “My Name is Vendetta,” and “Wednesday.”

“The bottom line is there’s a massive amount of password sharing, particularly among affluent people,” told Jason Helfstein, head of internet research at Oppenheimer.

“We do think a good chunk of [Netflix] subscribers will probably pay more to keep certain members of their household, or let’s say their children who no longer live with them, on their plan,” he continued.

Helfstein, who described the crackdown as a “net positive” in the long term, added Netflix, “would not be doing this if they thought they would end up in a worse revenue situation.”

“This is a company that historically has prided itself on customer service, above all,” Helfstein said.

“The reality is people have taken advantage of it. Sharing your Netflix account with 20 other people is probably not what the company had in mind, [but] if people are reasonable and share this with five, six people in their family? I think it’s going to work out.”

Source: finance.yahoo.com